On This Page

About This Guide

This section describes how to use this guide and where to find further information.

Audience and Purpose

This guide is written for resellers and

merchants who want to use

Secure Acceptance

Hosted Checkout Integration

to process payments without handling or storing sensitive

payment information on their own servers. Using

Secure Acceptance

Hosted Checkout Integration

requires minimal scripting skills. You must create a security

script and modify your HTML form to invoke Secure Acceptance

. You will also use the Business Center

to review and manage orders.Conventions

These special statements are used in this document:

An

Important

statement contains information essential to

successfully completing a task or learning a concept.A

Warning

contains information or instructions, which, if not

heeded, can result in a security risk, irreversible loss of data, or significant cost in

time or revenue or both.Customer Support

For support information about any service, visit the Support Center:

Recent Revisions to This Document

25.08.01

Updated the required browsers. See Required Browsers.

Updated the

bill_to_address_state

request field

maximum length to 20. See Request Fields.Updated the

bill_to_company_name

request field

maximum length to 60. See Request Fields.Updated the

req_bill_to_address_state

response

field maximum length to 20. See Response Fields.Updated the

req_bill_to_company_name

response field

maximum length to 60. See Response Fields.Added these new response fields. See Response Fields.

- payment_token_instrument_identifier_id

- payment_token_instrument_identifier_new

- payment_token_instrument_identifier_status

25.05.01

Added China UnionPay test cards. See Testing Transactions.

Added the

auth_trans_ref_no

request field. See Request Fields.25.02

This revision contains only editorial changes and no technical updates.

25.01

Added information about China UnionPay cards

that do not have a card verification number (CVN) and expiration date. See the Important

note in Adding Card Types and Currencies.

Updated the

auth_trans_ref_no

, payer_authentication_eci

, and

payer_authentication_enroll_e_commerce_indicators response fields.

See

Response Fields.24.06

Added information about China UnionPay cards that do not have a card verification number

(CVN) and expiration date. See the Important note in Adding Card Types and Currencies.

24.05

Updated the Important note about signing request fields. See Request Fields.

24.04

This revision contains only editorial changes and no technical updates.

Website Requirements

Your website must meet these requirements:

- It must have a shopping cart, customer order creation software, or an application for initiating disbursements to send funds to payment accounts.

- It must contain product pages in one of the supported scripting languages. See Sample Transaction Process Using JSP.

- The IT infrastructure must be Public Key Infrastructure (PKI) enabled to use SSL-based form POST submissions.

- The IT infrastructure must be capable of digitally signing customer data before submission toSecure Acceptance.

VISA Platform Connect: Specifications and Conditions for

Resellers/Partners

The following are specifications and conditions that apply to a Reseller/Partner enabling

its merchants through

Cybersource for

. Failure to meet any of the specifications and conditions below is

subject to the liability provisions and indemnification obligations under

Reseller/Partner’s contract with Visa/Cybersource.Visa Platform Connect

(“VPC”)

processing- Before boarding merchants for payment processing on a VPC acquirer’s connection, Reseller/Partner and the VPC acquirer must have a contract or other legal agreement that permits Reseller/Partner to enable its merchants to process payments with the acquirer through the dedicated VPC connection and/or traditional connection with such VPC acquirer.

- Reseller/Partner is responsible for boarding and enabling its merchants in accordance with the terms of the contract or other legal agreement with the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that all considerations and fees associated with chargebacks, interchange downgrades, settlement issues, funding delays, and other processing related activities are strictly between Reseller and the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that the relevant VPC acquirer is responsible for payment processing issues, including but not limited to, transaction declines by network/issuer, decline rates, and interchange qualification, as may be agreed to or outlined in the contract or other legal agreement between Reseller/Partner and such VPC acquirer.

DISCLAIMER: NEITHER VISA NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR ANY ERRORS OR

OMISSIONS BY THE

Visa Platform Connect

ACQUIRER IN PROCESSING TRANSACTIONS. NEITHER VISA

NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR RESELLER/PARTNER BOARDING MERCHANTS OR

ENABLING MERCHANT PROCESSING IN VIOLATION OF THE TERMS AND CONDITIONS IMPOSED BY THE

RELEVANT Visa Platform Connect

ACQUIRER. Secure Acceptance

Hosted Checkout Integration Overview

Secure Acceptance

Hosted Checkout Integration

OverviewCybersource

Secure Acceptance

Hosted Checkout Integration

is your secure hosted customer checkout

experience. It consists of securely managed payment forms or as a single-page

payment form for capturing payment card data, processing transactions, enabling you

to simplify your Payment Card Industry Data Security Standard (PCI DSS) compliance

and reduce risks associated with handling and/or storing sensitive payment card

information. You, the merchant, out-source capturing and managing sensitive payment

card data to Secure Acceptance

, which is designed to accept card payments.Secure Acceptance

is designed to process transaction requests

directly from the customer browser so that sensitive payment data does not pass

through your servers. If you do intend to send payment data from

your servers, use the REST API, SOAP Toolkit API, or the Simple Order API.

Sending

server-side payments using Secure Acceptance

incurs unnecessary overhead and

could result in the suspension of your Secure Acceptance

profileTo create your customer's

checkout

experience, take these steps:

- Create and configureSecure Acceptanceprofiles.

- Update the code on your web site to render theHosted Checkout Integrationand immediately process card transactions. See Scripting Language Samples. Sensitive card data bypasses your network and is accepted bySecure Acceptancedirectly from the customer.Cybersourceprocesses the transaction on your behalf by sending an approval request to your payment processor in real time. See Secure Acceptance Hosted Checkout Integration Transaction Flow.

- Use the response information to display an appropriate transaction response page to the customer. You can view and manage all orders inthe Business Center. See Viewing Transactions in the Business Center.

Required Browsers

You must use one of these browsers in order to ensure that the

Secure Acceptance

checkout flow is fast and secure.Internet Explorer is no longer supported.

Desktop browsers:

- Chrome 80, released February 4, 2020 or later

- Edge 109, released January 12, 2023 or later

- Firefox 115, released June 29, 2023 or later

- Opera 106, released December 19, 2023 or later

- Safari 13, released September 20, 2019 or later

Mobile browsers:

- Android Browser 123, released March 12, 2024 or later

- Chrome Mobile 80, released February 4, 2020 or later

- iOS Safari 13, released September 20, 2019 or later

Secure Acceptance Profile

Secure Acceptance

ProfileA

Secure Acceptance

profile consists of settings that you configure to create a

customer checkout experience. You can create and edit multiple profiles, each offering a

custom checkout experience. See Custom Checkout Appearance. For

example, you might need multiple profiles for localized branding of your websites. You can

display a multi-step checkout process or a single page checkout to the customer as

well as configure the appearance and branding, payment options, languages, and customer

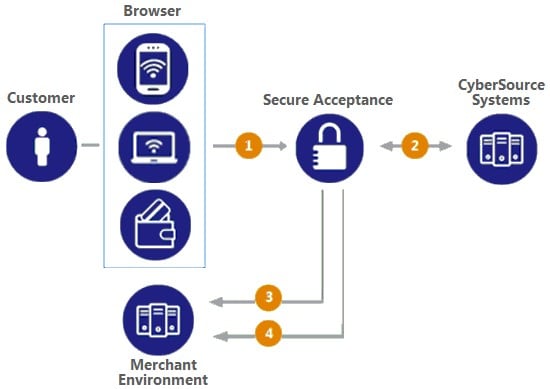

notifications. See Checkout Configuration.Secure Acceptance Hosted Checkout Integration Transaction Flow

Secure Acceptance

Hosted Checkout Integration

Transaction FlowFigure:

Hosted Checkout Integration

Transaction Flow

- The customer clicks thepaybutton on your website, which triggers an HTTPS POST that directs the customer to thehostedthat you configured inSecure Acceptancepagethe Business Center. The HTTPS POST includes the signature and signed data fields containing the order information.Hosted Checkout Integrationworks best with JavaScript and cookies enabled in the customer browser.Your system should sign all request fields with the exception of fields that contain data the customer is entering. To prevent malicious actors from impersonatingCybersource, do not allow unauthorized access to the signing function. See Required Signed Fields.

- Secure Acceptanceverifies the signature to ensure that the order details were not amended or tampered with and displays the. The customer enters and submits payment detailsHosted Checkout Integrationpageandtheir billing and shipping information. The customer confirms the payment, and the transaction is processed.

- Cybersourcerecommends that you configure a custom receipt page inthe Business Centerso that the signed transaction response is sent back to your merchant server through the browser. See Merchant Notifications. You must validate the response signature to confirm that the response data was not amended or tampered with.Hosted Checkout Integrationcan also display a standard receipt page to your customer, and you can verify the result of the transaction search inthe Business Centeror the standardCybersourcereports.If the response signature in the response field does not match the signature calculated based on the response data, treat the POST as malicious and disregard it.Secure Acceptancesigns every response field. Ignore any response fields in the POST that are not in thesigned_fieldsfield.

- Cybersourcerecommends that you implement the merchant POST URL notification as a backup means of determining the transaction result. This method does not rely on your customer's browser. You receive the transaction result even if your customer lost connection after confirming the payment. See Merchant Notifications.If the transaction type if sale, it is immediately submitted for settlement. If the transaction type isauthorization, use theCybersourceSimple Order API to submit a capture request when goods are shipped.

Payment Tokens

Contact

Cybersource

Customer Support to

activate your merchant account for the

Token Management Service

(TMS

). You

cannot use payment tokens until your account is activated and you have

enabled payment tokens for Secure Acceptance

. See Creating a Secure Acceptance Profile.Payment tokens are unique identifiers that replace sensitive payment

information and that cannot be mathematically reversed.

Cybersource

securely stores all the card information, replacing

it with the payment token. The token is also known as a subscription ID,

which you store on your server.The payment token replaces the card

or ACH bank account

number, and optionally

the associated billing, shipping, and card information. No sensitive card

information is stored on your servers, thereby reducing your PCI DSS

obligations.Tokens That Represent a Card or Bank Account Only

Instrument identifier tokens

created using the Token

Management Service (TMS) and third-party tokens

represent a payment card number or

bank account number. The same card number or bank account number sent in multiple token

creation calls results in the same payment token being returned. TMS instrument identifier and third-party tokens cannot be

updated. If your merchant account is configured for one of these token types, you

receive an error if you attempt to update a token.

When using

Secure Acceptance

with tokens that represent only the card number or bank account, you must include associated data, such as expiration dates and billing address data, in your transaction request.One-Click Checkout

With

one-click checkout

, customers can buy products with a single click. Secure Acceptance

is integrated to Cybersource

tokenization

, so returning

customers are not required to enter their payment details. Before a customer can use

one-click checkout, they must create a payment token during the first transaction on the

merchant website. See Payment Token Transactions. The payment token

is an identifier for the payment details; therefore, no further purchases require that you

enter any information. When the payment token is included in a payment request, it

retrieves the card, billing, and shipping information related to the original payment

request from the payment repository.To use one-click checkout, you must include the one-click checkout endpoint to process the

transaction. See Endpoints and Transaction Types.

Subscription Payments

A customer subscription contains information that you store in the

Cybersource

database and use for future billing. At any time, you can send a

request to bill the customer for an amount you specify, and Cybersource

uses the payment token to retrieve the card, billing, and shipping information to process

the transaction. You can also view the customer subscription in the Business Center. See

Viewing Transactions in the Business Center.A customer subscription includes:

- Customer contact information, such as billing and shipping information.

- Customer payment information, such as card type, masked account number, and expiration date.

- Customer order information, such as the transaction reference number and merchant-defined data fields.

Type of Subscription | Description |

|---|---|

Recurring | A recurring billing service with no specific end date. You

must specify the amount and frequency of each payment and the start date for

processing the payments. Cybersource creates a schedule based

on this information and automatically bills the customer according to the

schedule. For example, you can offer an online service that the customer

subscribes to and can charge a monthly fee for this service. See Recurring Payments. |

Installment | A recurring billing service with a fixed number of scheduled

payments. You must specify the number of payments, the amount and frequency of

each payment, and the start date for processing the payments. Cybersource creates a schedule based on this information and

automatically bills the customer according to the schedule. For example, you

can offer a product for 75.00 and let the customer pay in three installments of

25.00. See Installment Payments. |

Level II and III Data

and III

DataSecure Acceptance

supports Level II and III

data. Level II cards, also known as Type II cards, provide customers with additional information on their payment card statements. Business and corporate cards along with purchase and procurement cards are considered Level II cards.Level III data can be provided for purchase cards, which are payment cards used by employees to make purchases for their company. You provide additional detailed information—the Level III data—about the purchase card order during the settlement process. The Level III data is forwarded to the company that made the purchase, and it enables the company to manage its purchasing activities.

Payouts Payment Tokens

Use

Secure Acceptance

to create a payment token that can be used with the Payouts API or batch submissions.Creating a Payment Token for Payouts

- Create aSecure AcceptanceProfile and define your checkout page. See Payment Configuration or Portfolio Management for Resellers.

- For transaction processing, create a payment token. See Payment Tokens.

- Set the Payouts subscription ID field to the value of the payment token.

RESULT

Go-Live with Secure Acceptance

Secure Acceptance

Cybersource

recommends that you submit all banking information and required integration services before going live. Doing so will speed up your merchant account configuration.When you are ready to implement

Secure Acceptance

in your live environment, you must

contact Cybersource

Customer Support and request Go-Live. When all the

banking information has been received by Cybersource

, the Go-Live procedure

can require three days to complete. Go-Live implementations do not occur on Fridays.Payment Configuration

This section describes the process for configuring your account to accept payments.

Creating a Secure Acceptance Profile

Secure Acceptance

ProfileContact

Cybersource

Customer Support to enable your account for Secure Acceptance

. You must activate a profile in order to use it. See Activating a Profile.- Log in to the Business Center:

ADDITIONAL INFORMATION

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- ClickNew Profile. The Create Profile page appears.

- Enter or verify these profile details.

ADDITIONAL INFORMATION

- Profile Name

- TheSecure Acceptanceprofile name is required and cannot exceed 40 alphanumeric characters.

- Profile Description

- The profile description cannot exceed 255 characters.

- Integration Method

- Check.Hosted Checkout Integration

- Company Name

- The company name is required and cannot exceed 40 alphanumeric characters.

- Company Contact Name

- Enter company contact name.

- Company Contact Email

- Enter company contact email.

- Company Phone Number

- Enter company contact phone number.

- Payment Tokenization

- CheckPayment Tokenization. For more information, see Payment Transactions.

- Decision Manager

- Check. For more information,Decision Managersee Decision Manager.

- Verbose Data

- CheckVerbose Data. For more information,see Decision Manager.

- Generate Device Fingerprint

- CheckGenerate Device Fingerprint. For more information,see Decision Manager.

- ClickSubmit.

Payment Method Configuration

You must configure at least one payment method before you can activate a profile.

A payment method selection page is displayed as part of the

checkout process for any of these scenarios:

- Multiple payment methods are enabled for the profile, and nopayment_methodfield is included in the request.

- payment_method=visacheckoutis included in the request.

- Visa Click to Payis the only enabled payment method for the profile. See Enabling the Payment Method for Visa Click to Pay.

Visa Click to Pay uses Visa Checkout

services and API fields.

You can skip displaying the payment method selection page by

specifying card

or echeck

as the only available payment method.

.Customers can change the payment method during the checkout

process.

Adding Card Types and Currencies

For each card type you choose, you can also manage currencies

and

payer authentication options

. Choose only the types of payment cards and

currencies that your merchant account provider authorizes.The card verification number (CVN) is a three- or four-digit number that helps ensure that the customer possess the card at the time of the transaction.

Secure Acceptance does not process transactions

for cards that do not have a card verification number (CVN) and expiration date. Most

China UnionPay debit and credit cards issued before 2016 do not have a CVN and

expiration date. You must decide whether you will require the CVN.

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- ClickAdd Card Types. The list of card types appear.

- Check each card type that you want to offer to the customer as a payment method. Your payment processor must support the card types.

- Click the settings icon for each card type. The card settings and currencies lists appear.

- CheckCVN Displayto display the CVN field onSecure Acceptance. The customer decides whether to enter the CVN.Cybersourcerecommends that you display the CVN to reduce fraud.

- CheckCVN Required. The CVN Display option must also be checked. If this option is checked, the customer is required to enter the CVN.Cybersourcerecommends that you require the CVN to reduce fraud.

- CheckPayer Authentication.

- Check the currencies for each card.

ADDITIONAL INFORMATION

By default, all currencies are listed as disabled. You must select at least one currency. Contact your merchant account provider for a list of supported currencies. If you select the Elo or Hipercard card type, only the Brazilian real currency is supported. - ClickSubmit. The card types are added as an accepted payment type.

- ClickSave.

Payer Authentication

Configuration

Payer Authentication

ConfigurationPayer Authentication

is the Cybersource

implementation of 3-D Secure. It prevents unauthorized card use and provides added

protection from fraudulent chargeback activity. Secure Acceptance

supports 3-D Secure

1.0 and 2.0.Before you can use Payer Authentication, you must contact Customer

Support to configure your account. Your merchant ID must be enabled for payer

authentication. For more information about payer authentication, see the

Payer

Authentication Developer Guides

.For

Secure Acceptance

, Cybersource

supports these kinds of payer authentication: - American Express SafeKey

- China UnionPay (3-D Secure 2.0 only)

- Diners ProtectBuy

- J/Secure by JCB

- Mastercard Identity Check

- Visa Secure

For each transaction, you receive detailed information in the replies and in the

transaction details page of

the

. You can store this information for

12 months. Business Center

Cybersource

recommends that you store the payer authentication

data because you can be required to display this information as enrollment verification for

any payer authentication transaction that you present again because of a chargeback.Your merchant account provider can require that you provide all data in human-readable

format.

The language used on each payer authentication page is determined by your issuing bank and

overrides the locale you have specified. If you use the test card numbers for testing

purposes the default language used on the payer authentication page is English and

overrides the locale you have specified. See Test and View Transactions.

Configuring Payer Authentication

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- Choose a 3-D Secure version. If you choose 3‑D Secure 2.0 and the card issuer is not 3‑D Secure 2.0 ready, some transactions might still authenticate over 3‑D Secure 1.0. Thepayer_authentication_specification_versionresponse field indicates which version was used.

- ClickSave. The card types that support payer authentication are:

- American Express

- Cartes Bancaires

- China UnionPay

- Diners Club

- JCB

- Mastercard

- Maestro (UK Domestic or International)

- Visa

Enabling Automatic Authorization Reversals

For transactions that fail to return an address verification system (AVS) or a card

verification number (CVN) match, you can enable

Secure Acceptance

to perform an

automatic authorization reversal. An automatic reversal releases the reserved funds held

against a customer's card.- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckFails AVS check. Authorization is automatically reversed on a transaction that fails an AVS check.

- CheckFails CVN check. Authorization is automatically reversed on a transaction that fails a CVN check.

- ClickSave.

ADDITIONAL INFORMATION

When the AVS and CVN options are disabled and the transaction fails an AVS or CVN check, the customer is notified that the transaction was accepted. You are notified to review the transaction details. See Types of Notifications.

Enabling ACH Payments

An ACH payment is a payment made directly from your customer's U.S. or Canadian bank account. As

part of the checkout process, you must display a terms and conditions statement for ACH

transactions.

A customer must accept the terms and conditions before submitting an order. Within the terms and conditions statement it is recommended that you include a link to the table of returned item fees. The table lists by state the amount that your customer has to pay when a check is returned.

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckEnable Echeck Payments. The list of account types appears.

- Check the account type(s):

- Checking

- Savings

- Corporate Checking

- General Ledger

- ClickAdd Currencies. The ACH settings page appears.

- CheckSelect Allor check each currency.

- ClickSave.

RESULT

You must configure the ACH information fields. See Configuring ACH Information Fields.

Visa Click to Pay Configuration

Visa Click to Pay

ConfigurationVisa Click to Pay uses Visa Checkout services and API fields.

The payment methods selection page is displayed as part of the checkout process for these scenarios:

- Multiple payment methods are enabled for the profile, and nopayment_methodfield is included in the request.

- Visa Click to Payis the only enabled payment method for the profile.

- payment_method=visacheckoutis included in the request.

Visa Click to Pay

requires the customer to enter only a username and password to pay for goods. It eliminates the need to enter account, shipping, and billing information. The customer logs in to their Visa Click to Pay

account and chooses the card with which they would like to pay. If the Secure Acceptance

profile is enabled to request the payer authentication service for a specific card type, the customer is redirected to the relevant payer authentication screen before Secure Acceptance

processes the transaction and redirects the customer to your website.Configuring Visa Click to Pay

Visa Click to Pay

- In the left navigation panel, choosePayment Configuration > Digital Payment Solutions. The Digital Payment Solutions page appears.

- ClickConfigure. The Visa Merchant Services Agreement appears.

- Review theVisa Click to PayServices Agreement, then clickAgree and Create Account. TheVisa Click to PayConfiguration panel opens to the Merchant Configuration section.

- Enter your payment details.

- ClickSubmit.

Enabling the Payment Method for Visa Click to Pay

Visa Click to Pay

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckEnable.Visa Click to Pay

- Enter the name of theVisa Click to Payprofile to be used. If no profile name is entered, the defaultVisa Click to Payprofile is used.

- Check the card types to request the payer authentication service for:

- Visa—the Visa Secure service is requested.

- Mastercard—the Mastercard Identity Check service is requested.

- American Express—the American Express SafeKey service is requested.

ADDITIONAL INFORMATION

- Indicate when to reject transactions based on a certain criterion:

- Billing address details are incorrect (AVS fail).

- Security code is incorrect (CVV/CVN fail).

- TheVisa Click to Payrisk score is above your specified score. Select the risk score to use with your fraud model. A value of 0 indicates that a risk score will not be taken into account, and a higher risk score indicates a higher perceived fraud risk.

- ClickSave.

Enabling PayPal Express Checkout

PayPal Express Checkout is not supported on a

Secure Acceptance

iframe integration.Contact

Cybersource

Customer Support to have your account configured for this feature. You must also create a PayPal business

account. See

Add the PayPal Express Checkout payment method to the

Hosted Checkout Integration

payment methods selection page. Redirect the customer to their PayPal account login. When logged in to their PayPal account they can review orders and edit shipping or payment details before completing transactions.The payment methods selection page is displayed as part of the checkout process when multiple payment methods are enabled for the profile and no

payment_method

field is included in the request. If you include payment_method=

paypal

in the request, the payment methods selection page is not displayed, and the customer is redirected to PayPal.- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckEnable PayPal Express Checkout.

- CheckAllow customers to select or edit their shipping address within PayPalto allow customers to edit the shipping address details that they provided in the transaction request toSecure Acceptance. Customers select a new address or edit the address when they are logged in to their PayPal account.

- When the transaction type is authorization, check one of these options:

- Request a PayPal authorization and include the authorization response values in the response—check this option to create and authorize the PayPal order.The customer funds are not captured using this option. You must request a PayPal capture; see the PayPal guide. If the transaction type issale,Secure Acceptanceauthorizes and captures the customer funds.

- Request a PayPal order setup and include the order setup response values in the response—check this option to create the PayPal order.The customer funds are not authorized or captured using this option. You must request a PayPal authorization followed by a PayPal capture request; see the PayPal guide. If the transaction type issale,Secure Acceptanceauthorizes and captures the customer funds.

- ClickSave.

Security Keys

Before you can activate a profile, you must create a security key to protect each transaction from data tampering.

A security key expires in two years.

You cannot use the same security key for both test and production transactions.

You must download a security key for each version of

Secure Acceptance

for test and production.On the Profile Settings page, click

Security

.

The Security Keys page appears.

The security script signs the request fields using the secret key and the HMAC SHA256 algorithm.

To verify data, the security script generates a signature to compare with the signature returned from the Secure Acceptance

server.Creating Security Keys

- Log in to theBusiness Center.

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickSecurity. The security keys page appears.

- Click the Create Key plus sign (+).

- Enter a key name (required).

- Choose signature version 1 (default).

- Choose signature methodHMAC-SHA256(default).

- ClickCreate.

- ClickConfirm. The Create New Key window expands and displays the new access key and secret key. This panel closes after 30 seconds.

- Copy and save or download the access key and secret key.

- Access key: Secure Sockets Layer (SSL) authentication withSecure Acceptance. You can have many access keys per profile. See Scripting Language Samples.

- Secret key: signs the transaction data and is required for each transaction. Copy and paste this secret key into your security script. See Scripting Language Samples.When done pasting the secret keys into your script, delete the copied keys from your clipboard or cached memory.

RESULT

By default, the new security key is active. The other options for each security key

are:

- Deactivate: deactivates the security key. The security key is inactive.

- Activate: activates an inactive security key.

- View: displays the access key and security key.

When you create a security key, it is displayed in the security keys table. You can

select a table row to display the access key and the secret key for that specific

security key.

Checkout Configuration

The payment form is the customer's checkout experience. It consists of either a series of pages or as a single checkout page in which the customer enters or reviews information before submitting a transaction. Select the fields that you want displayed on the single checkout page or on each page of the multi-step checkout process: billing, shipping, payment, and order review.

Configuring the Payment Form

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- Choose the payment form flow:

- Multi-step payment form—the checkout process consists of a sequence of pages on which the customer enters or reviews information before submitting a transaction. The default sequence is payment selection (if multiple payment methods are enabled), billing, shipping, payment, review, and receipt.

- Single page form—the checkout process consists of one page on which the customer enters or reviews information before submitting a transaction.

ADDITIONAL INFORMATION

Do not clickSaveuntil you have selected the billing or shipping fields, or both. - CheckDisplay the total tax amount in each step of the checkout process.

ADDITIONAL INFORMATION

The total tax amount must be included in each transaction. Calculate and include the total tax amount in thetax_amountfield.Do not clickSaveuntil you have selected the billing or shipping fields, or both. - ClickSave.

Configuring Billing Information Fields

Select the billing information fields that your merchant

provider requires. If the billing country is U.S. or Canada, you can select the state

code field as a required field.

Cybersource

recommends that if the

billing country is U.S. or Canada, the state code and the postal code fields be selected

as required. If the billing country is located in the rest of the world, you can also

select the state code field as a required field.Select the customer billing information fields that you want displayed on

Secure Acceptance

. If these fields are captured at an earlier stage of the order process

(for example on your website), they can be passed into Secure Acceptance

as hidden

form fields. See Request Fields. You can shorten the checkout

process by not selecting billing information.- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- CheckBilling Information. The billing information fields appear.

- Check the billing information fields that your merchant provider requires. The options for each field are:

- Display: the customer can view the information displayed in this field. Choose this option if you want to pre-populate the billing information fields when theis rendered—these fields must be passed intoSecure AcceptanceHosted CheckoutSecure Acceptanceas hidden form fields.

- Edit: the customer can view and edit the billing information on the. When you select this option, the display option is automatically selected.Secure AcceptanceHosted Checkout

- Require: the customer is required to enter the billing information on thebefore they submit the transaction. When you select this option, all other options are automatically selected.Secure AcceptanceHosted Checkout

ADDITIONAL INFORMATION

Do not clickSaveuntil you have selected the billing and order review fields. - Indicate whether to mask sensitive fields.

- ClickSave.

Configuring Shipping Information Fields

Select the shipping information fields that your merchant provider requires.

Select the customer shipping information fields that you want displayed on

Secure Acceptance

. These fields are optional. If you do not add these fields, the

shipping information step is removed from Secure Acceptance

. If these fields are

captured at an earlier stage of the order process (for example, on your website), they

can be passed into Secure Acceptance

as hidden form fields. See Request Fields. You can shorten the checkout process by not selecting

shipping information.- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- CheckShipping Information.

- Check the shipping information fields that your merchant provider requires. The options for each field are:

- Display: the customer can view the information displayed in this field. Choose this option if you want to pre-populate the shipping information fields when theis rendered—these fields must be passed intoSecure AcceptanceHosted CheckoutSecure Acceptanceas hidden form fields.

- Edit: the customer can view and edit the shipping information on the. When you select this option, the display option is automatically selected.Secure AcceptanceHosted Checkout

- Require: the customer is required to enter the shipping information on thebefore they submit the transaction. When you select this option, all other options are automatically selected.Secure AcceptanceHosted Checkout

ADDITIONAL INFORMATION

Do not clickSaveuntil you have selected the shipping and order review fields. - Indicate whether to mask sensitive fields.

- ClickSave.

Configuring ACH Information Fields

Select the ACH account information fields that your merchant provider requires.

Select the customer ACh account information fields that you want displayed on

Secure Acceptance

.- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- Check the ACH account information to be included inSecure Acceptance. The options for each field are:

- Display: The customer can view the information displayed in this field. Choose this option if you want to pre-populate the ACH information fields when theis rendered.Secure AcceptanceHosted Checkout

- Edit: The customer can view and edit the ACH information on the. When you select this option, the display option is automatically selected.Secure AcceptanceHosted Checkout

- Require: The customer is required to enter the ACH information on thebefore they submit the transaction. When you select this option, all other options are automatically selected.Secure AcceptanceHosted Checkout

- Indicate whether to mask sensitive fields.

- ClickSave.

Configuring Order Review Details

Select the fields that you want displayed on the Order Review page of

the

. The customer reviews this information before submitting a

transaction.Secure Acceptance

checkout- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- Check the fields that you want displayed on the Order Review page of. The options for each field are:Secure AcceptanceHosted Checkout

- Display: the customer can view the information contained in this field. Available only for billing and shipping information.

- Edit: the customer can view and edit the information contained in this field.

- ClickSave.

Merchant Notifications

Secure Acceptance

sends merchant and customer notifications in response to transactions. You can receive a merchant notification by email or as an HTTPS POST to a URL for each transaction processed. Both notifications contain the same transaction result data.Ensure that your system acknowledges POST notifications (even when under load) as quickly as possible. Delays of more than 10 seconds might result in delays to future POST notifications.

Cybersource

recommends that you implement the merchant POST URL to receive notification of each transaction. Parse the transaction response sent to the merchant POST URL and store the data within your order management system. This ensures the accuracy of the transactions and informs you when the transaction was successfully processed.Configuring Merchant Notifications

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickNotifications. The Notifications page appears.

- Choose a merchant notification in one of two ways:

- CheckMerchant POST URL. Enter the HTTPS URL.Cybersourcesends transaction information to this URL. For more information, see Response Fields. Only an HTTPS URL supporting TLS 1.2 or higher should be used for the merchant POST URL. If you encounter any problems, contactCybersourceCustomer Support.

- CheckMerchant POST Email. Enter your email address.Cybersourcesends transaction response information to this email address including payment information, return codes, and all relevant order information. See Response Fields.

- Choose the card number digits that you want displayed in the merchant or customer receipt:

- Return payment card BIN: displays the card's Bank Identification Number (BIN), which is the first six digits of the card number. All other digits are masked: 123456xxxxxxxxxx

- Return last four digits of payment card number: displays the last four digits of the card number. All other digits are masked: xxxxxxxxxxxx1234

- Return BIN and last four digits of payment card number: displays the BIN and the last four digits of the card number. All other digits are masked: 123456xxxxxx1234

- ClickSave.

Customer Receipts

You can send a purchase receipt email to your customer and a copy to your own email address. Both are optional. Customers can reply with questions regarding their purchases, so use an active email account. The email format is HTML unless your customer email is rich text format (RTF).

Configuring Customer Notifications

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickNotifications. The Notifications page appears.

- CheckEmail Receipt to Customer.

- Enter the sender email address to be displayed on the customer receipt. The customer will reply to this email with any queries.

- Enter the sender name of your business. It is displayed on the customer receipt.

- CheckSend a copy to. This setting is optional.

- Enter your email address to receive a copy of the customer's receipt.

ADDITIONAL INFORMATION

Your copy of the customer receipt will contain additional transaction response information. - CheckDisplay Notification Logo.

- ClickUpload Company Logo. Find and upload the image that you want to display on the customer receipt and email.

ADDITIONAL INFORMATION

The image file must not exceed 840 (width) x 60 (height) pixels and must be GIF, JPEG, or PNG. The logo filename must not contain any special characters, such as a hyphen (-). - CheckCustom Email Receipt.

ADDITIONAL INFORMATION

Cybersourcerecommends that you implement a DNS configuration to enableCybersourceto send email receipts on your behalf. - Check the type of email receipt you want to send to a customer:

- Standard email receipt: this email is automatically translated based on the locale used for the transaction.

- Custom email receipt: this email can be customized with text and data references. The email body section containing the transaction detail appears between the header and footer. Custom text is not translated when you use different locales.

- CheckCustom Email Subjectand enter up to 998 characters. When the maximum number of characters is exceeded, the subject heading defaults toOrder Confirmation.

ADDITIONAL INFORMATION

You can insert email smart tags in the email subject, header, and footer sections to include specific information. Select each smart tag from the drop-down list and click Insert. - ClickSave.

Customer Response Page

You must configure the customer response page before you can activate a profile.

You can choose to have a transaction response page displayed

to the customer at the end of the checkout process, and a cancel response page displayed

during the checkout process. Enter a URL for your own customer response page, or use the

Cybersource

hosted response pages. Depending upon the transaction

result, the Cybersource

hosted response pages are Accept, Decline, or

Error. Review declined orders as soon as possible because you might be able to correct

problems related to address or card verification, or you might be able to obtain a verbal

authorization. You can also choose to display a web page to the customer after the checkout

process is completed.Configuring a Cybersource Hosted Response Page

Cybersource

Hosted Response Page- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickCustomer Response. The Customer Response page appears.

- Under the Transaction Response Page heading, checkHosted by.Cybersource

- Under the Transaction Response Message heading, choose a number from theRetry Limitdrop-down list. The maximum number of times a customer can retry a declined transaction is five.

- Under the Customer Redirect after Checkout heading, enter the redirect URL of the web page. This web page is displayed to the customer after the checkout process is completed.

- ClickSave. The Profile Settings page appears.

Configuring a Custom Hosted Response Page

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickCustomer Response. The Customer Response page appears.

- Under the Transaction Response Page heading, checkHosted by You.

- Enter the URL for your customer response page. Use port 80, 443, or 8080 in your URL.

ADDITIONAL INFORMATION

Only port 443 should be used with a HTTPS URL.A POST request with the transaction data is provided to this URL after the customer completes checkout.The POST request contains the reason code value of the transaction, which helps you determine possible actions to take on the transaction.See Reason Codes. - Under the Transaction Response Message heading, choose a number from theRetry Limitdrop-down list. The maximum number of times a customer can retry a declined transaction is 5.

- Under the Customer Redirect after Checkout heading, enter the redirect URL of the web page. This web page is displayed to the customer after the checkout process is completed.

- ClickSave.

Configuring a Custom Cybersource Hosted Response Page

Cybersource

Hosted Response Page- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickCustomer Response. The Customer Response page appears.

- Under the Custom Cancel Response Page heading, checkHosted by.Cybersource

- ClickSave.

Configuring a Custom Cancel Response Page

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickCustomer Response. The Customer Response page appears.

- Under the Custom Cancel Response Page heading, checkHosted by You.

- Enter the URL for your customer response page. Use port 80, 443, or 8080 in your URL.

ADDITIONAL INFORMATION

Only port 443 should be used with a HTTPS URL.A POST request with the transaction data is provided to this URL after the customer completes checkout.The POST request contains the reason code value of the transaction, which helps you determine possible actions to take on the transaction.See Reason Codes. - ClickSave.

Custom Checkout Appearance

Customize the appearance and branding of the

Secure Acceptance

checkout pages by choosing a background color, font, and text color. Upload a logo or image, and align it within the header or footer.Cybersource

recommends that you preview your changes in the Image Preview window. To display an image as the header banner of the payment form, the image dimensions must not exceed 840 (width) x 60 (height) pixels and the image size must not exceed 100 kB. To display a small logo within the header banner, the logo height must not exceed 60 pixels. The image file must be GIF, JPEG, or PNG.

Changing the Header Content

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickBranding. The Branding page appears.

- CheckDisplay Header.

- Click the header color icon.

- Choose a color in one of two ways:

- Enter a hexadecimal value for the header color of the payment form.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- ClickBrowseto upload the image to display as the header banner or as a logo within the header banner.

- Choose the alignment option for the image or logo: left-aligned, centered, or right-aligned.

- ClickSave.

Changing the Body Color and Font Settings

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickBranding. The Branding page appears.

- Choose a background color for the main body in one of two ways:

- Enter a hexadecimal value for the background color.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- Select a text font from the drop-down list.

- Choose a text color in one of two ways:

- Enter a hexadecimal value for the text color.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- ClickSave.

- ClickSet to Defaultto restore all the default settings on this page.

Changing the Total Amount Background and Text Color

If you are implementing the iframe embedded version of

Hosted Checkout Integration

, the total amount

figure is not displayed within the iframe. Any settings you select below are

ignored.- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickBranding. The Branding page appears.

- Choose a background color in one of two ways:

- Enter a hexadecimal value for the background color.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- Choose a text color in one of two ways:

- Enter a hexadecimal value for the text color of the total amount.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- ClickSave.

- ClickSet to Defaultto restore all the default settings on this page.

Changing the Progress Bar Color

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickBranding. The Branding page appears.

- Choose a color in one of two ways:

- Enter a hexadecimal value for the color of the progress bar.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- ClickSave.

- ClickSet to Defaultto restore all the default settings on this page.

Changing the Color and Text on the Pay or Finish Button

- In the left navigation panel, choosePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Choose a profile. The General Settings page appears.

- ClickBranding. The Branding page appears.

- Choose a background color of the pay or the finish button in one of two ways:

- Enter a hexadecimal value for the background color.

- Click within the header color palette to choose a color. Click the color icon to confirm your selection.

- Choose a color of the pay or the finish button text in one of two ways:

- Enter a hexadecimal value for the text.

- Click within the header color palette to choose a color. Click the icon at the bottom right to confirm your selection.

- CheckChange Button text. A text box appears for the pay button.

- Enter the text you want displayed on the pay button. This button text is required.

- Enter the text you want displayed on the finish button. This button text is required.

- ClickSave.

- ClickSet to Defaultto restore all the default settings on this page.

Checkout Language Localization

Secure Acceptance

supports multiple languages. This table lists all the supported

languages and the locale code that you must include in your payment form.From the list, include the locale code in the

locale

request field

on your payment form. See Sample Transaction Process Using JSP.Example: American English

<input type="hidden" name="locale" value="en-us">

Language | Locale Code |

|---|---|

Arabic | ar-xn |

Catalan | ca-es |

Chinese—Hong Kong | zh-hk |

Chinese—Macau | zh-mo |

Chinese—Mainland | zh-cn |

Chinese—Singapore | zh-sg |

Chinese—Taiwan | zh-tw |

Croatian | hr-hr |

Czech | cs-cz |

Danish | da-dk |

Dutch | nl-nl |

English—United States of America | en-us |

English—Australia | en-au |

English—Great Britain | en-gb |

English—Canada | en-ca |

English—Ireland | en-ie |

English—New Zealand | en-nz |

Finnish | fi-fi |

French | fr-fr |

French—Canada | fr-ca |

German | de-de |

German—Austria | de-at |

Greek | el-gr |

Hebrew | he-il |

Hungary | hu-hu |

Indonesian | id-id |

Italian | it-it |

Japanese | ja-jp |

Korean | ko-kr |

Lao People's Democratic Republic | lo-la |

Malaysian Bahasa | ms-my |

Norwegian (Bokmal) | nb-no |

Philippines Tagalog | tl-ph |

Polish | pl-pl |

Portuguese—Brazil | pt-br |

Slovakian | sk-sk |

Spanish | es-es |

Spanish—Argentina | es-ar |

Spanish—Chile | es-cl |

Spanish—Colombia | es-co |

Spanish—Mexico | es-mx |

Spanish—Peru | es-pe |

Spanish—United States of America | es-us |

Swedish | sv-se |

Thai | th-th |

Turkish | tr-tr |

Vietnamese | vi-vn |

Activating a Profile

You must complete the required settings described in each of these sections before

you can activate a profile:

- On the left navigation pane, click thePayment Configuration >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- Perform one of these steps:

- On the Active Profiles tab, select the profile that you want to activate, and click thePromote Profileicon.

- On the Edit Profile page, click thePromote Profileicon.

- ClickConfirm.

Additional Profile Options

- Deactivate—deactivates the active profile. The profile is now listed in the inactive profile list. This option is available only for an active profile.

- Create Editable Version—duplicates the active profile and creates an editable version. The editable version is listed in the inactive profile list. This option is available only for an active profile.

- Promote to Active—activates the inactive profile. This option is available only for an inactive profile.

Portfolio Management for Resellers

This section describes how to manage portfolios for your merchants.

Reseller: Creating a Secure Acceptance Profile

Secure Acceptance

ProfileContact

Cybersource

Customer Support to enable your account for Secure Acceptance

. You must activate a profile in order to use it. See Activating a Profile.- Log in to the Business Center:

ADDITIONAL INFORMATION

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceSettingsSecure AcceptanceSettings page appears.

- ClickNew Profile. The Create Profile page appears.

- Enter or verify these profile details.

ADDITIONAL INFORMATION

Profile DetailsProfile DetailDescriptionProfile NameTheSecure Acceptanceprofile name is required and cannot exceed 40 alphanumeric characters.Profile DescriptionThe profile description cannot exceed 255 characters.Integration MethodCheck.Hosted Checkout IntegrationCompany NameThe company name is required and cannot exceed 40 alphanumeric characters.Company Contact NameEnter company contact information: name, email, and phone number.Company Contact EmailCompany Phone NumberPayment TokenizationCheckPayment Tokenization. For more information, see Payment Transactions.Decision ManagerCheck. For more information,Decision Managersee Decision Manager.Verbose DataCheckVerbose Data. For more information,see Decision Manager.Generate Device FingerprintCheckGenerate Device Fingerprint. For more information,see Decision Manager. - ClickSubmit.

Payment Method Configuration

You must configure at least one payment method before you can activate a profile.

Visa Click to Pay uses Visa Checkout

services and API fields.

A payment method selection page is displayed as part of the

checkout process for any of these scenarios:

- Multiple payment methods are enabled for the profile, and nopayment_methodfield is included in the request.

- payment_method=visacheckoutis included in the request.

- Visa Click to Payis the only enabled payment method for the profile. See Reseller: Configuring Visa Click to Pay.

You can skip the payment method selection page by specifying

card or echeck as the only available payment method. See Reseller: Enabling ACH Payments.

Customers can change the payment method during the checkout

process.

Reseller: Adding Card Types and Currencies

For each card type you choose, you can also manage currencies and payer authentication options. Choose only the types of payment cards and currencies that your merchant account provider authorizes.

The card verification number (CVN) is a three- or four-digit number that helps ensure that the customer possesses the card at the time of the transaction.

Secure Acceptance does not process transactions for

cards that do not have a card verification number (CVN) and expiration date. Most China

UnionPay debit and credit cards issued before 2016 do not have a CVN and expiration

date. You must decide whether you will require the CVN.

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- ClickAdd Card Types. The list of card types appear.

- Check each card type that you want to offer to the customer as a payment method. Your payment processor must support the card types.

- ClickSettingsfor each card type. The card settings and currencies lists appear.

- Check CVN Display to display the CVN field onSecure Acceptance. The customer decides whether to enter the CVN.Cybersourcerecommends displaying the CVN to reduce fraud.

- Check CVN Required. The CVN Display option must also be checked. If this option is checked, the customer is required to enter the CVN.Cybersourcerecommends requiring the CVN to reduce fraud.

- Check the currencies for each card.

ADDITIONAL INFORMATION

By default, all currencies are listed as disabled. You must select at least one currency. Contact your merchant account provider for a list of supported currencies. If you select the Elo or Hipercard card type, only the Brazilian Real currency is supported. - ClickSubmit. The card types are added as an accepted payment type.

- ClickSave.

Payer Authentication Configuration

Payer authentication is the

Cybersource

implementation of 3-D Secure. It

deters unauthorized card use and provides added protection from fraudulent chargeback

activity. Secure Acceptance

supports 3-D Secure 1.0 and 2.0.Before you can use

Cybersource

Payer Authentication, you must contact

Cybersource

Customer Support so that Cybersource

can

configure your account. Your merchant ID must be enabled for payer authentication. For more

information about payer authentication, see the Payer

Authentication Developer Guides

.For

Secure Acceptance

, Cybersource

supports these kinds of payer

authentication: - American Express SafeKey

- China UnionPay (3-D Secure 2.0 only)

- Diners ProtectBuy

- J/Secure by JCB

- Mastercard Identity Check

- Visa Secure

For each transaction, you receive detailed information in the replies and in the

transaction details page of the Business Center. You can store this information for 12

months.

Cybersource

recommends that you store the payer authentication data

because you can be required to display this information as enrollment verification for any

payer authentication transaction that you present again because of a chargeback.Your merchant account provider can require that you provide all data in human-readable

format.

The language used on each payer authentication page is determined by your issuing bank and

overrides the locale that you specified. If you use the test card numbers, the default

language used on the payer authentication page is English and overrides the locale you have

specified. See Test and View Transactions.

Reseller: Configuring Payer Authentication

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- Choose the 3-D Secure version that you want to use. If you choose 3-D Secure 2.0 and the card issuer is not 3-D Secure 2.0 ready, some transactions might still authenticate over 3-D Secure 1.0. Thepayer_authentication_specification_versionresponse field indicates which version was used.

- ClickSave. The card types that support payer authentication are:

- American Express

- Cartes Bancaires

- China UnionPay

- Diners Club

- JCB

- Mastercard

- Maestro (UK Domestic or International)

- Visa

Reseller: Enabling Automatic Authorization Reversals

For transactions that fail to return an address verification system (AVS) or a card

verification number (CVN) match, you can enable

Secure Acceptance

to perform an

automatic authorization reversal. An automatic reversal releases the reserved funds held

against a customer's card.- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckFails AVS check. Authorization is automatically reversed on a transaction that fails an AVS check.

- CheckFails CVN check. Authorization is automatically reversed on a transaction that fails a CVN check.

- ClickSave.

ADDITIONAL INFORMATION

When the AVS and CVN options are disabled and the transaction fails an AVS or CVN check, the customer is notified that the transaction was accepted. You are notified to review the transaction details. See Types of Notifications.

Reseller: Enabling ACH Payments

An ACH payment is a payment made directly from your customer's U.S. or Canadian

bank account. As part of the checkout process, you must display a terms and conditions

statement for ACH transactions.

A customer must accept the terms and conditions

before submitting an order. Within the terms and conditions statement it is recommended

to include a link to the table of returned item fees. The table lists by state the

amount that your customer has to pay when a check is returned.

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckEnable Echeck Payments. The list of account types appears.

- Check the account type(s):

ADDITIONAL INFORMATION

- Checking

- Savings

- Corporate Checking

- General Ledger

- ClickAdd Currencies. The ACH settings page appears.

- CheckSelect Allor select a currency.

- ClickSave.

RESULT

You must configure the ACH information fields. See

Reseller: Configuring ACH Information Fields.

Visa Click to Pay Configuration

Visa Click to Pay

ConfigurationVisa Click to Pay uses Visa Checkout services and API fields.

The payment methods selection page is displayed as part of the checkout process for either

of these scenarios:

- Multiple payment methods are enabled for the profile and no payment_method field is included in the request.

- Visa Click to Payis the only enabled payment method for the profile.

- payment_method=visacheckoutis included in the request.

Visa Click to Pay

requires the customer to enter only a username and password to

pay for goods. It eliminates the need to enter account, shipping, and billing information.

The customer logs in to their Visa Click to Pay

account and chooses the card with

which they would like to pay. If the Secure Acceptance

profile is enabled to request

the payer authentication service for a specific card type, the customer is redirected to

the relevant payer authentication screen before Secure Acceptance

processes the

transaction and redirects the customer to your website.Reseller: Configuring Visa Click to Pay

Visa Click to Pay

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- Check EnableVisa Click to Pay.

- ClickSave.

- In the left navigation panel, choosePayment Configuration > Digital Payment Solutions.

- ClickSave.

RESULT

To configure the payment method for

Visa Click to Pay

, log in to the Business Center

and go to Configuring

.Visa Click to Pay

Reseller: Enabling PayPal Express Checkout

PayPal Express Checkout is not supported on a

Secure Acceptance

iframe integration.Contact

Cybersource

Customer Support to have your Cybersource

account configured for this feature. You must also create a PayPal business account; see PayPal Express Checkout Services Using Alternative Payment Services Simple Order API

.Add the PayPal Express Checkout payment method to

the

When logged in to their PayPal account they can review orders and edit shipping or payment details before completing transactions.Secure Acceptance

Hosted Checkout Integration

payment methods selection page. Redirect the customer to their PayPal account login.The payment methods selection page is displayed as part of the checkout process when multiple payment methods are enabled for the profile and no

payment_method

field is included in the request. If you include payment_method=

paypal

in the request, the payment methods selection page is not displayed and the customer is redirected to PayPal.- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckEnable PayPal Express Checkout.

- ClickSave.

Service Fees

Contact

Cybersource

Customer Support to have your Cybersource

account configured for this feature. Service fees are supported only if Wells Fargo is your acquiring bank and FDC Nashville Global is your payment processor.The service fee setting applies to the card and ACH payment methods. To apply the service

fee to only one payment method, create two

Secure Acceptance

profiles with the

appropriate payment methods enabled on each: one with the service fee feature enabled and

one with the service fee feature disabled.As part of the checkout process, you must display a terms and conditions statement for the service fee. A customer must accept the terms and conditions before submitting an order.

Reseller: Enabling Service Fees

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Settings. The Payment Settings page appears.

- CheckService Fee applies on transactions using this profile. The service fee terms and conditions URL and the service fee amount are added to the customer review page.

ADDITIONAL INFORMATION

Transactions fail if you disable this feature. Do not disable this feature unless instructed to do so by your account manager. - ClickSave.

ADDITIONAL INFORMATION

After you save the profile you cannot disable the service fee functionality for that profile. All transactions using the profile will include the service fee amount.

Security Keys

Before you can activate a profile, you must create a security key to protect each transaction from data tampering.

A security key expires in two years.

You cannot use the same security key for both test and production transactions. You must

download a security key for each versions of

Secure Acceptance

for test and production.On the Profile Settings page, click

Security

.

The Security Keys page appears.

The security script signs the request fields using the secret key and the HMAC SHA256 algorithm.

To verify data, the security script generates a signature to compare with the signature returned from the Secure Acceptance

server.

You must have an active security key to activate a profile.Reseller: Creating Security Keys

- In the left navigation panel, choosePayment Configuration > Key Management.

- ClickGenerate Key.

- Select a key type.

- ClickNext Step.

- Select the key subtype.Secure Acceptance

- ClickNext Step.

- Enter a key name (required).

- Choose signature version1.

- Choose signature methodHMAC-SHA256.

- Select a security profile.

- ClickSubmit.

- ClickGenerate Key. The Create New Key window expands and displays the new access key and secret key. This window closes after 30 seconds.

- Copy and save the access key and secret key.

ADDITIONAL INFORMATION

- Access key: Secure Sockets Layer (SSL) authentication withSecure Acceptance. You can have many access keys per profile. See Scripting Language Samples.

- Secret key: signs the transaction data and is required for each transaction. Copy and paste this secret key into your security script. See Scripting Language Samples.

When done pasting the secret keys into your script, delete the copied keys from your clipboard or cached memory.By default, the new security key is active. The other options for each security key are:- Deactivate: deactivates the security key. The security key is inactive.

- Activate: activates an inactive security key.

- View: displays the access key and security key.

When you create a security key, it is displayed in the security keys table. You can select a table row to display the access key and the secret key for that specific security key. - ClickKey Management. The Key Management page appears.

Reseller: Configuring the Payment Form

- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- Choose the payment form flow:

- Multi-step payment form—the checkout process consists of a sequence of pages on which the customer enters or reviews information before submitting a transaction. The default sequence is payment selection (if multiple payment methods are enabled), billing, shipping, payment, review, and receipt.

- Single page form—the checkout process consists of one page on which the customer enters or reviews information before submitting a transaction.

ADDITIONAL INFORMATION

Do not clickSaveuntil you have selected the billing or shipping fields, or both. - CheckDisplay the total tax amount in each step of the checkout process.

ADDITIONAL INFORMATION

The total tax amount must be included in each transaction. Calculate and include the total tax amount in thetax_amountfield.Do not clickSaveuntil you have selected the billing or shipping fields, or both. - ClickSave.

Reseller: Configuring Billing Information Fields

Select the billing information fields that your merchant

provider requires.

If the billing country is U.S. or Canada, you can select the state

code field as a required field.

Cybersource

recommends that if the

billing country is U.S. or Canada, the state code and the postal code fields bee

selected as required. If the billing country is located in the rest of the world, you

can also select the state code field as a required field.Select the

customer billing information fields that you want displayed on

Secure Acceptance

.

If these fields are captured at an earlier stage of the order process (for example on

your website), they can be passed into Secure Acceptance

as hidden form fields. See

Request Fields. You can shorten the checkout process by not

selecting billing information.- In the left navigation panel, choosePortfolio Management >. TheSecure AcceptanceProfilesSecure AcceptanceProfile page appears.

- Choose a profile. The General Settings page appears.

- ClickPayment Form. The Payment Form page appears.

- CheckBilling Information. The billing information fields appear.