On This Page

Paze Integration Guide

This section describes how to use this guide and where to find further information.

- Audience and Purpose

- ThePaze Integration Guideis for banks and credit unions that want to offer the Paze online checkout experience and process Paze digital wallet payments throughCybersource. The guide describes how to process and search for Paze transactions. Processing is described for Paze digital wallet payment authorizations. The method you use to extract and decrypt Paze payment data depends on how you integrated Paze into your system.

- Conventions

- IMPORTANTAnImportantstatement contains information essential to successfully completing a task or learning a concept.

- Related Documentation

- Visit theCybersourcedocumentation hub to find additional technical documentation.

- Customer Support

- For support information about any service, visit the Support Center:

Recent Revisions to This Document

25.06.01

Initial release.

Introduction to Paze

Paze is an online checkout option, or

digital wallet

, that enables you to

offer customers a fast and secure way to make purchases online.

If you integrate Paze into your ecommerce page,

you can process Paze transactions in the same manner as your standard card processing

and you have access to the consumers enrolled in Paze.This guide describes how to submit transactions that originate from the Paze payment method to

the

Cybersource

system for authorization.Two Paze Decryption Methods

Integration hooks for two Paze decryption methods are built into the

payment management platform.

The two decryption methods—merchant decryption and

decryption—handle Paze encrypted payment data differently.

You will integrate the decryption method that best suits your technical development

environment in terms of desired degree of exposure to, or control over, sensitive

payment information.

Cybersource

Cybersource

IMPORTANT

The Paze decryption method that you integrate

determines how you will format your API request messages when you

authorize a payment.

- Merchant decryption

- For merchant decryption, you (the merchant or the integrator) are responsible for the generation of the payment encryption keys, decryption of the payment response payload from Paze, and mapping the information—including the Paze payment token—to the correspondingCybersourceREST API fields for an authorization request. With merchant decryption, payment instrument details remain visible to you, and you control the technical development that decrypts this information.

- decryptionCybersource

- Fordecryption, you integrate the Paze wallet directly on your checkout page.Cybersourcecreates and manages the Paze decryption keys and extracts and decrypts the sensitive payment information on your behalf. HavingCybersourceprocess your Paze transactions reduces your PCI compliance burden. For information about the PCI Data Security Standard (DSS), see the PCI Security Standards Council.Cybersource

IMPORTANT

The Paze decryption method that you integrate

determines how you will format your API request messages when you

authorize a payment.

Supported Payment Cards

Cybersource

Visa Platform Connect

payment gateway

,

provided that the cards are enrolled in Paze with participating banks and credit unions

:- Mastercard

- Visa

Getting Started with Paze

This section covers information you need to know

before you begin to integrate Paze into your system:

- Requirements for integrating Paze

- Steps for integrating Paze

Requirements for Integrating Paze Into Your System

- Client ID.You have obtained a client ID fromCybersource.

- Acquirer.You have an active contract with the acquirer.

- Payment processor.You are registered with a payment processor that connects with the acquirer.

- Processor and acquirer relationship.An acquirer might require you to use a payment processor that has an existing relationship with the acquirer.

For an overview of

merchant financial institutions (acquirers),

customer financial institutions (issuers),

payment networks, and

payment processors

that work together to enable payment services, see the .

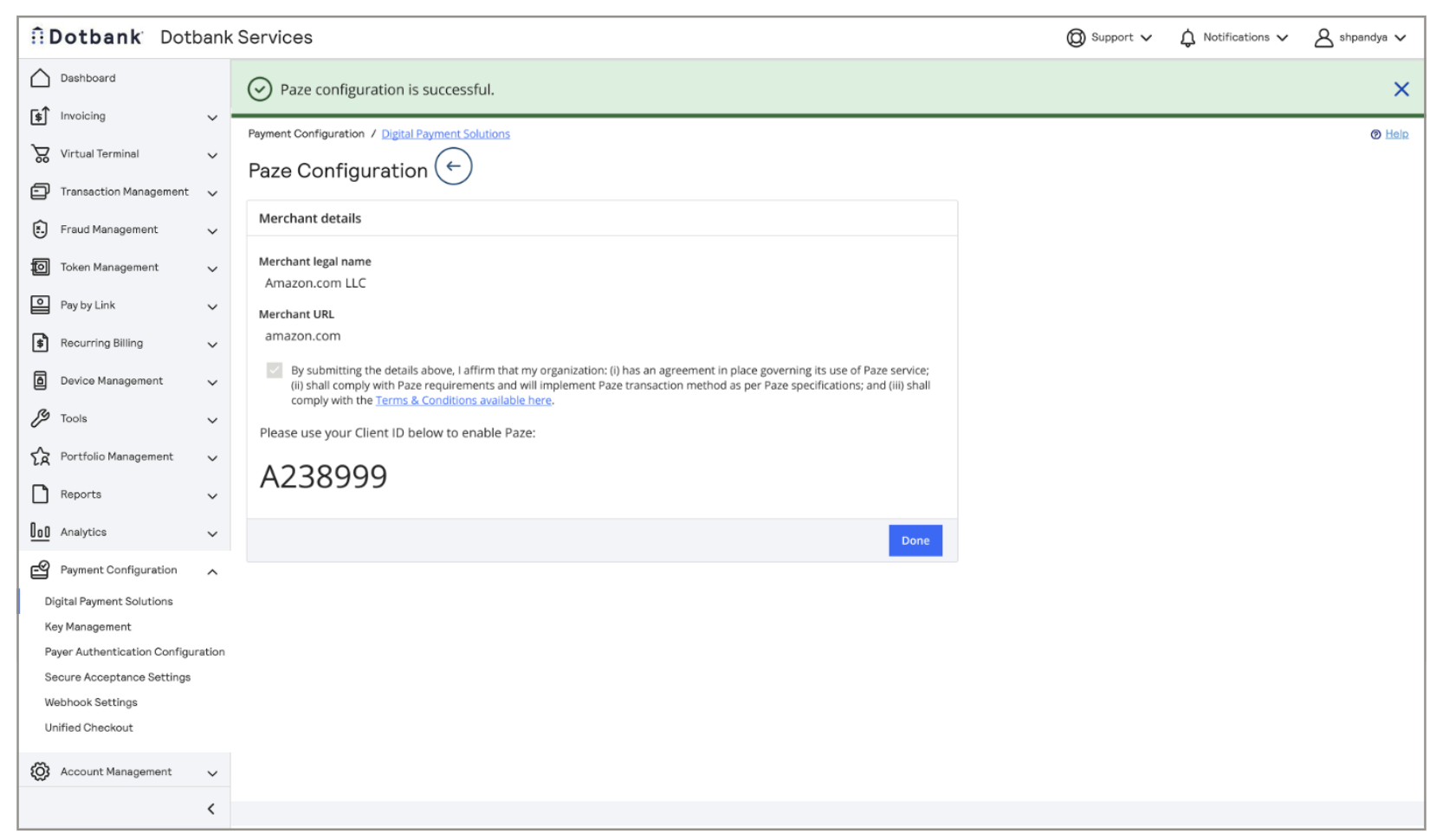

Obtain the Merchant Client ID for the Paze Service

- Follow these steps to obtain the merchant's client ID for the Paze service:

- In the left navigation panel, click the Payment Configuration icon.

- ClickDigital Payment Solutions. The Digital Payment Solutions page appears.

- ClickConfigurenext to the product name Paze. The Paze Configuration page appears.

ADDITIONAL INFORMATION

- Enter the merchant's legal name and the merchant URL.

- Select the checkbox to indicate that the organization's agreements with these terms: (i) the organization has an agreement in place governing its use of the Paze service; (ii) the organization will comply with Paze requirements and will implement the Paze transaction method as per Paze specifications; and (iii) the organization will comply with the Terms and Conditions that are linked in the Paze Configuration page.

- ClickSave. The merchant's client ID appears on the page. The client ID can be used to enable Paze.

ADDITIONAL INFORMATION

Merchant Decryption Requires Generation of a Key Pair

IMPORTANT

For merchant decryption only,

you must generate a public/private key pair

based on your merchant client ID.

Paze Response to a Complete API Call

After a customer finalizes a purchase using the Paze button on your checkout page, you invoke

the Paze

Complete

JavaScript SDK API to initiate the transaction. Paze

responds by sending an encrypted payment response payload in a JSON Web Encryption (JWE) data

object. The payload contains the cryptograms, network tokens, electronic commerce indicators

(ECI), and other payment instrument data required to complete the payment. The payment data is

a Base64-encoded value contained in the response.completeResponse

property.If you integrated the

decryption method for Paze,

Cybersource

Cybersource

decrypts the Base64-encoded data on your behalf.This code example shows a Paze response to a Complete API call:

{ "request": { "transactionType": "PURCHASE", "enhancedTransactionData": {}, "transactionOptions": { "billingPreference": "ALL", "merchantCategoryCode": "5940", "payloadTypeIndicator": "PAYMENT" }, "transactionValue": { "transactionAmount": "100.95", "transactionCurrencyCode": "USD" }, "sessionId": "f2559bc7-f8c2-4a02-a4a1-5a89ea44cd81" }, "response": { "completeResponse": "eyJhdWQiOiJmaWxlOlwvXC8iLCJraWQiOiJkZTkxM2E3NS02OWI1LTRkZTQtYWJiOS03YmNmMTJiYjcxMDAiLCJpc3MiOiJodHRwczpcL1wvc2FuZGJveC5kaWdpdGFsd2FsbGV0LmVhcmx5d2FybmluZy5jb20iLCJ0eXAiOiJKV1QiLCJleHAiOjE2ODYxNzAwNzksImlhdCI6MTY4NTk5NzI3OSwiYWxnIjoiUlMyNTYiLCJqdGkiOiI1QzdCODRCQjRDMDBmMTdmZjM3YS1lODE5LTM0MDQtNGQwYi0xZmMzODdkYjlkMDIifQ.eyJwYXlsb2FkSWQiOiI1QzdCODRCQjRDMDBmMTdmZjM3YS1lODE5LTM0MDQtNGQwYi0xZmMzODdkYjlkMDIiLCJzZXNzaW9uSWQiOiJmMjU1OWJjNy1mOGMyLTRhMDItYTRhMS01YTg5ZWE0NGNkODEiLCJzZWN1cmVkUGF5bG9hZCI6ImV5SmhkV1FpT2lKbWFXeGxPbHd2WEM4aUxDSnJhV1FpT2lKamVXSnpMVzFwWkMxaUxUQXhJaXdpYVhOeklqb2lhSFIwY0hNNlhDOWNMM05oYm1SaWIzZ3VaR2xuYVhSaGJIZGhiR3hsZEM1bFlYSnNlWGRoY201cGJtY3VZMjl0SWl3aVkzUjVJam9pU2xkVUlpd2lkSGx3SWpvaVNsZFVJaXdpWlc1aklqb2lRVEkxTmtkRFRTSXNJbVY0Y0NJNk1UWTROakUzTURBM09Td2lhV0YwSWpveE5qZzFPVGszTWpjNUxDSmhiR2NpT2lKU1UwRXRUMEZGVUMweU5UWWlMQ0pxZEdraU9pSTFRemRDT0RSQ1FqUkRNREJtTVRkbVpqTTNZUzFsT0RFNUxUTTBNRFF0TkdRd1lpMHhabU16T0Rka1lqbGtNRElpZlEuTUF1YXp2MlpqQ2owYkZfVjVqZ25YVTd2ZE5UUVpuNW9NSC11eVhQY0N2ekFENkl1ZXZjOTEwdUxmM2ItdnNPMzZhQzdqanFaVGtJOTNMUG44akVGd1UwM0JBS05NUW9fV1IzTHhfbXVqYmNWR1k4bW96Q2Z3RWYzNmh2emZXWC1LSExSbkN5ZHR4eF9FOTZ2bjRYM1N2X1BYYVdJSlNsSWhjeVF5OUxlXzlXWVZFRnVHSDRBd3E3MGZNS29KdHQ3TVoxZWFGaWtCOE5BTFJYZUZuWi00eGM4NFl6VzhnV0pYMHhfZTNHc3doN0d5RV9WZDhuT2hrcFJTR0tSUkkwS1hwSk9xV1JURjRVcEVPX09zdmMyVmUxd3lOLWRzU0VnaUtQcUF5MzNzTzRSb0pKeDlxZ0U0eU5zdm50NDRJb0wycHFnWlZKeDZHdDBZWGhRcjYxMlFBLmNxY0xJcXRDMEpWekpLcWUuR1Etd1E1bUlyZmtLRWhGX2FYNkxIZzZnd2FuTlFRdmFWbFpQVGlneUQ2WjVjd2RZb1JyazczZ1FmdzduU21RQnRoNS04MUdLcnlMVmFDLURqeThqUk04WmE2MF9md25GdENla3NoVy03QmtOcllSZXFGNnJERWVlVEg3TnRHYnpnenVhRmNqbUNteUgyQlZFYjJ4RXRRV3BlTnlnTWNrQ0FKRmYxLXBwSUxJUkI5VjJCMDRvd3pNYXNjUHFsQ1VPR3I3U00wWGtBOWRtelRCQlAteU92RU9qUEhFbDhGOUlyY0QzM1ZtaGRMZzJMeXdFMmNLV053alcybTJMdlF1NWVwS0NiWi1WRVU3ME1xc1VhZ1ljY3hBZnFkRnh5N3MyWi0tQ25NbEVubjFhaUtUWUVyWGhGNk5LT1IwbjZ5eHhsUExsOWJ6ejZWX3NiRjZSazV1M3JnRDhDOVU3U1dPb2UyYmNleVlINlVVOEo4VzlrQy1peTJ3am4ySEdyTkVMQ0F0MmRlUTdxejI3NlVCeFF6V21TV0RyZmJ1S19fencxcEhjMkRFdlg5ZktDNmxJVUg2c2xWanBpU2N3MUFmNWlmSmhEMlFNZ2pjUmFfTmoxUHgyY09FcUxDX1NQTjJzWDM4VFRuYUcxMV9JZVk0b0p0bTlUS2diQ1EzSU9pdHlFYlFJcG9qSUlHMHBvVmtYeGxoWENKOURCWnpqSDNxanNTTTJROHdIdlEzcjU3WDdtLXd4anphTDVMdmZwNWRnVTQ4UndjX1YxZkFhZ3pxT1BobXNveldhbmQ4dmEyNHZoYlFiNXZxNHVFdXBLU0V6anQ3WlFLM2k2SS1lZExCWlhYT3VsOFk5cFo0MlM2elB5S3oyTFZ4Y3JxMnlXNDdOVnpMVmhZZjRmTWducjhUVkNzWUlHVzhhNDcyOEdVaktXMmM0Z0R1aDlxMC1MVXZja1pmR244bTJYREF0dmxUUkhSeG16c3ZrN1lOTG9nV053T0NpZ0RuckdCU3lqLU5UdXVxM3BGNWpIV1kyMTU5d2tNcHNVeFdGRkZRTnViZGZzSXBxdUpkLW81OHpWSkU4T2x0NmhBQ2gtV1huenpmOC1pY1BBMVozeklKVGd1bF9WekpxOUpDdzd5WmEteWIwQ2RIWEVMT0s5Q1dIOGlGRWh6d2hzTW9nRDEwQUZCUG5GYUY5bFZyWjJsc2pSWWF6dG5hbkRONERXd3J1dTR0d0pCSllCaFF1WDNHT0VHVkJmX1hqMjh3ME95aWJyRTdnOUQzZjI2TUdPb2t5bXlkRTA2NjVXc1IyMjlzbV9yeURpdzNnZGEzTUp4M2wyYjBWYmhraFRuSVdyLWhIU3ljTXRxV2lQVTJ3VzI5TXRtQlhPdENmMWZUMm13bFJYY2dmeFd3NnQyNlJSSnYtWkE1VTBvdWE1a1Z3bWlodTN2a1MwakhMY3dqUkZxeU5ESkp6OTlFdUFoaUU0UnR3MVBkZWU2cHA5TjJsXzRHSE9OMHdWVF9yZ0tvckd2US1UU3pYNGRUTjAyZjV2c3dTZmZMdTlqVWEzZEpab0J2MFl4UG4zOE1UYlA3MG1MeU8zZWdhWlo3ZjlvdWZuM0ZxdTlZR2dabjg1azBWUWRLTHZVU05tdGRGNmJEQmYwd0t5T3p3cUNNRmdISnAtNkJUSXpXZGR5TWJaUkdJQlJNVG44WXN2SXptZlNHT3UxWHpkZFhhbXZ3Z2ZwSkhHdUhqRDA4dmFMZkRvZTVTNklmRV9CZDVleXkyZUo4QnFWeEhrdlRJa0h1bEVIekNJVGx2bHdiUTl2b1BYczJUQXF4ZExoek43VElRTl9FRUpoUHg1OWdZZU1DY2FrMFJyZ253V01TZm5XY3VWZmI3NnNSVTZoa05xY0JUWHZBek10ZkxCQ2I0ajlHaG9vNE4zNURFbW5fNkZXdUVkT0Y5cTM3YVRCRjhpWEQ0RWZva19NODV3NjhFSG01eFNPZGhzTENSUHRobkI3VllScnJSTDVZOHhRUkVEcVpHMHR2TlVudl95UHZaQzItNzJUaWVPamplZXg3Y204a1dFeWpHR0RiQ25uTEl4YkR6VzBING00YmJrTENaVVAtVjdESVRBYk9qSEh4VWgwbmRxcC12bmFkZFc4X0FUcTVqaXBZalA0YkQ0OGlkeFN2WHlVQkpJNDktTFllZl9ZVmhnVzh1U2tjWjEtUWIybThaRlpCTEFXUmF2MjZuSkt3cjFEWUdrX2xVZVZwbGpOdl9LdXl1VVBFNVUyYllEdVNUTmtIVGVhNzZsaW1ocDRuYmx1QmwwTmUzblhGR1pucVU4M1NMRDdkSF9GYlR3UGoxZzF0YVg1bTIzazZlcTNhcEtXWEZ5VnpNZG9BbVZqQ2lYWnltTUxnbFlUMHpFVUNKanNLNzJGV1N3X3RNZ3NOa3p3Vm1KWVl0VVJPbUx5LXM0MmZxOTlULWRtVHFLMWJMRWJwYU9KTkZFVllXOHczVWlVd2FWdDhkM1R3azBfSTVqZ1lsNzNLeFJZZVhFdW9oN0d4ZFhXYXNhdkMxTVRPXzlwc0VNeVl4SllCWFJwcnBaeVBpZ2N6aGRic24wR2pDb09CQzhVWnoxOG5zemFWaHhOUG9XdldqeHJqdmhnd0lFMTFSY0ZIQl9PMnlGS0FwRXJPWFF4MkxMcklWNl9qS2drS2dJazUzRG1TdW9oaG1WaWdnYU5ORHIyNm93WjFQVDQ1aFVqLU9tVERqUDNZVXpfeEZ4QXV6cGY5M2E4SkVVei1zdGZ6ZUxRVVFQcHRTcVFKNHB2TFRlU2FGbWlPR2JWZzB2SGtIbHFmYmNNRDB2OTJneTVFck1oaTczZndWRjFjbDIxY0djNk5RckcyQTNxSzF2SWRsMzVoSkY5ZEYwR0JacUtKeG13OTJfQk90bHpyRUxQVHVlYXhZaEYtZUNOUHN4ZXdQUDZwZC5JcE5wQURnNndOM0VNZUJaODRxOWdnIn0.llG8pQGpvpgMsaUkIrxdkYB0vUbKYORnA_iQc25EldokHh5naJEGnQ2sX4NWZmuntbt12adLqsoJ6H8x98Q6DmGJ-_wWQBYm_0plU2fkV-VIe_gbOLY4ZyxMc01bf1qH8tZl-ICyALrleHmP73R-cFKijTGOmguob1TFBOEoojoKcVIMqwC46k6F1tIEQGR-cZSaPhMtiijv4Xs6XQlvwUYwCVGAJKe4jUWM43MSYG9R0R3tfLuK2fZiAORUBA" } }

Depending on the Paze decryption method you integrated into your system,

the payment bundle is decrypted and then used

to make the authorization request to

Cybersource

.

Cybersource

then forwards the information to the payment network,

which includes your processor and the relevant payment card company:

- Merchant decryption

- If you use the merchant decryption method, send thedecrypted payment detailstoin theCybersourcepaymentInformation.tokenizedCardfields of the authorization request that you send to.Cybersource

- For detailed information, see Processing Paze Transactions with Merchant Decryption.

- decryptionCybersource

- If you integrated thedecryption method, send theCybersourceencrypted payment objecttoin theCybersourcepaymentInformation.fluidData.valuefield of the authorization request that you send to.Cybersource

- For detailed information, see Processing Paze Transactions with Cybersource Decryption.

Processing Paze Transactions with Merchant Decryption

When you use the merchant decryption method, you are responsible for

creating and managing the Paze decryption keys,

extracting and decrypting payment information from the Paze payload, and

mapping the required information to the

REST API fields for an authorization request.

Cybersource

This section of the guide shows you how to authorize Paze transactions using

merchant decryption:

- How to authorize a Mastercard payment on Paze with merchant decryption

- How to authorize a Visa payment on Paze with merchant decryption

Authorize a Mastercard Payment on Paze with Merchant Decryption

The topics in this section show you how to authorize a Mastercard payment on Paze

using the merchant decryption method.

Basic Steps: Authorizing a Mastercard Payment on Paze with Merchant Decryption

- Follow these steps to request a Paze payment authorization with merchant decryption for Mastercard:

- Create the request message with the requiredRESTAPI fields.

ADDITIONAL INFORMATION

- Use the API fields listed in Required Fields for Authorizing a Mastercard Payment on Paze with Merchant Decryption.

- Refer to the example in REST Example: Authorize a Mastercard Payment on Paze with Merchant Decryption.

- Send the message to one of these endpoints:

ADDITIONAL INFORMATION

- Production:POSThttps://api.cybersource.com/pts/v2/payments

- Test:POSThttps://apitest.cybersource.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Required Fields for Authorizing a Mastercard Payment on Paze with Merchant Decryption

As a best practice,

include these REST API fields

in your request for an authorization with the

merchant decryption implementation of Paze for Mastercard.

IMPORTANT

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements

for address data and expiration dates in payment transactions, see the .

- Set this field to the Token Secure cryptogram.

- Set this field to2for a Mastercard payment on Paze using merchant decryption.

- Set this field to the network token cryptogram.

- Set this field to the value from the payment network token expiration month.

- Set this field to the value from the payment network token expiration year.

- Set this field to the payment network token value.

- Set this field to1.

- Set this field to002for Mastercard.

- Set this field tospa.

- Set this field to029to specify the Paze payment solution.

REST Example: Authorize a Mastercard Payment on Paze with Merchant Decryption

Request

{ "clientReferenceInformation": { "code": "1234567890" }, "processingInformation": { "paymentSolution": "029", "commerceIndicator": "spa" }, "paymentInformation": { "tokenizedCard": { "number": "5432543254325432", "expirationMonth": "12", "expirationYear": "2031", "cryptogram": "ABCDEFabcdefABCDEFabcdef0987654321234567", "transactionType": "1", "type": "002" } }, "orderInformation": { "amountDetails": { "totalAmount": "100.00", "currency": "USD" }, "billTo": { "firstName": "Maya", "lastName": "Lee", "address1": "123MainSt", "locality": "SomeCity", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "maya.lee@email.world" } }, "consumerAuthenticationInformation": { "ucafAuthenticationData": "ABCDEFabcdefABCDEFabcdef0987654321234567", "ucafCollectionIndicator": "2" } }

Response to a Successful Request

{ "_links": { "authReversal": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/reversals" }, "self": { "method": "GET", "href": "/pts/v2/payments/6234236182176225003004" }, "capture": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/captures" } }, "clientReferenceInformation": { "code": "1234567890" }, "id": "6234236182176225003004", "orderInformation": { "amountDetails": { "authorizedAmount": "100.00", "currency": "USD" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2031", "prefix": "543254", "expirationMonth": "12", "suffix": "5432", "type": "002" }, "card": { "type": "002" } }, "pointOfSaleInformation": { "terminalId": "111111" }, "processingInformation": { "paymentSolution": "029" }, "processorInformation": { "approvalCode": "888888", "networkTransactionId": "123456789619999", "transactionId": "123456789619999", "responseCode": "100", "avs": { "code": "X", "codeRaw": "I1" } }, "reconciliationId": "75729760OPN67ZFV", "status": "AUTHORIZED", "submitTimeUtc": "2021-06-11T15:00:18Z" }

Authorize a Visa Payment on Paze with Merchant Decryption

The topics in this section show you how to authorize a Visa payment on Paze

using the merchant decryption method.

Basic Steps: Authorizing a Visa Payment on Paze with Merchant Decryption

- Follow these steps to request a Paze payment authorization with merchant decryption for Visa:

- Create the request message with the requiredRESTAPI fields.

ADDITIONAL INFORMATION

- Use the API fields listed in Required Fields for Authorizing a Visa Payment on Paze with Merchant Decryption.

- Refer to the example in REST Example: Authorize a Visa Payment on Paze with Merchant Decryption.

- Send the message to one of these endpoints:

ADDITIONAL INFORMATION

- Production:POSThttps://api.cybersource.com/pts/v2/payments

- Test:POSThttps://apitest.cybersource.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Required Fields for Authorizing a Visa Payment on Paze with Merchant Decryption

As a best practice,

include these REST API fields

in your request for an authorization with the

merchant decryption implementation of Paze for Visa.

IMPORTANT

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements

for address data and expiration dates in payment transactions, see the .

- Set this field tovbv.

- Set this field to the network token cryptogram.

- Set this field to the value from the payment network token expiration month.

- Set this field to the value from the payment network token expiration year.

- Set this field to the payment network token value.

- Set this field to1.

- Set this field to001for Visa.

- The mandate to use 3-D Secure for Paze transactions varies by geographic location.For Visa card transactions, 3-D Secure is calledVisa Secure.

- If the transaction does not use 3-D Secure, set this field to the ECI value contained in the Paze response payload.

- If the transaction uses 3-D Secure, set this field tovbv.

- Set this field to029to specify the Paze payment solution.

REST Example: Authorize a Visa Payment on Paze with Merchant Decryption

Request

{ "clientReferenceInformation": { "code": "1234567890" }, "processingInformation": { "paymentSolution": "029", "commerceIndicator": "vbv" }, "paymentInformation": { "tokenizedCard": { "number": "4111111111111111", "expirationMonth": "12", "expirationYear": "2031", "cryptogram": "AceY+igABPs3jdwNaDg3MAACAAA=", "transactionType": "1", "type": "001" } }, "orderInformation": { "amountDetails": { "totalAmount": "100.00", "currency": "USD" }, "billTo": { "firstName": "Maya", "lastName": "Lee", "address1": "123 Main St", "locality": "SomeCity", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "maya.lee@email.world" } }, "consumerAuthenticationInformation": { "cavv": "AceY+igABPs3jdwNaDg3MAACAAA=" } }

Response to a Successful Request

{ "_links": { "authReversal": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/reversals" }, "self": { "method": "GET", "href": "/pts/v2/payments/6234236182176225003004" }, "capture": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/captures" } }, "clientReferenceInformation": { "code": "1234567890" }, "id": "6234236182176225003004", "orderInformation": { "amountDetails": { "authorizedAmount": "100.00", "currency": "USD" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2031", "prefix": "411111", "expirationMonth": "12", "suffix": "1111", "type": "029" }, "card": { "type": "029" } }, "pointOfSaleInformation": { "terminalId": "111111" }, "processingInformation": { "paymentSolution": "029" }, "processorInformation": { "approvalCode": "888888", "networkTransactionId": "123456789619999", "transactionId": "123456789619999", "responseCode": "100", "avs": { "code": "X", "codeRaw": "I1" } }, "reconciliationId": "75729760OPN67ZFV", "status": "AUTHORIZED", "submitTimeUtc": "2021-06-11T15:00:18Z" }

Processing Paze Transactions with

Cybersource

Decryption

Cybersource

When you use the

decryption method,

creates and manages the Paze decryption keys and

decrypts and extracts payment information from the Paze payload

on behalf of the merchant.

You are responsible for mapping the required information to the

REST API fields for an authorization request.

Cybersource

Cybersource

Cybersource

This section of the guide shows you how to process Paze transactions using the

decryption method:

Cybersource

- How to authorize a Mastercard payment on Paze withdecryptionCybersource

- How to authorize a Visa payment on Paze withdecryptionCybersource

Authorize a Mastercard Payment on Paze with

Cybersource

Decryption

Cybersource

The topics in this section show you how to authorize a Mastercard payment on Paze

using the

decryption method.

Cybersource

Basic Steps: Authorizing a Mastercard Payment on Paze with

Cybersource

Decryption

Cybersource

- Follow these steps to request a Paze payment authorization withdecryption for Mastercard:Cybersource

- Create the request message with the requiredRESTAPI fields.

ADDITIONAL INFORMATION

- Use the API fields listed in Required Fields for Authorizing a Mastercard Payment on Paze with Cybersource Decryption.

- Refer to the example in REST Example: Authorize a Mastercard Payment on Paze with Cybersource Decryption.

- Send the message to one of these endpoints:

ADDITIONAL INFORMATION

- Production:POSThttps://api.cybersource.com/pts/v2/payments

- Test:POSThttps://apitest.cybersource.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Required Fields for Authorizing a Mastercard Payment on Paze with

Cybersource

Decryption

Cybersource

As a best practice,

include these REST API fields

in your request for an authorization with the

decryption implementation of Paze for Mastercard.

Cybersource

IMPORTANT

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements

for address data and expiration dates in payment transactions, see the .

- Set this field to the Base64-encoded value returned in the Paze payload in thecompleteResponseproperty of the complete payment response object.

- Set this field to1.

- Set this field to002for Mastercard.

- Set this field to029to identify Paze as the digital payment solution.

REST Example: Authorize a Mastercard Payment on Paze with

Cybersource

Decryption

Cybersource

Request

{ "clientReferenceInformation": { "code": "1234567890" }, "processingInformation": { "paymentSolution": "029" }, "paymentInformation": { "fluidData": { "value": "eyJkYXRhW5FINWZqVjfkak1NdVNSaE96dWF2ZGVyb2c9PSJ9" }, "tokenizedCard": { "type": "002", "transactionType": "1" } }, "orderInformation": { "amountDetails": { "totalAmount": "100.00", "currency": "USD" }, "billTo": { "firstName": "Maya", "lastName": "Lee", "address1": "123 Main St", "locality": "SomeCity", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "maya.lee@email.world" } } }

Response to a Successful Request

{ "_links": { "authReversal": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/reversals" }, "self": { "method": "GET", "href": "/pts/v2/payments/6234236182176225003004" }, "capture": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/captures" } }, "clientReferenceInformation": { "code": "1234567890" }, "id": "6234236182176225003004", "orderInformation": { "amountDetails": { "authorizedAmount": "100.00", "currency": "USD" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2031", "prefix": "128945", "expirationMonth": "12", "suffix": "2398", "type": "002" }, "card": { "type": "002" } }, "pointOfSaleInformation": { "terminalId": "111111" }, "processingInformation": { "paymentSolution": "029" }, "processorInformation": { "approvalCode": "888888", "networkTransactionId": "123456789619999", "transactionId": "123456789619999", "responseCode": "100", "avs": { "code": "X", "codeRaw": "I1" } }, "reconciliationId": "75729760OPN67ZFV", "status": "AUTHORIZED", "submitTimeUtc": "2021-06-11T15:00:18Z" }

Authorize a Visa Payment on Paze with

Cybersource

Decryption

Cybersource

The topics in this section show you how to authorize a Visa payment on Paze

using the

decryption method.

Cybersource

Basic Steps: Authorizing a Visa Payment on Paze with

Cybersource

Decryption

Cybersource

- Follow these steps to request a Paze payment authorization withdecryption for Visa:Cybersource

- Create the request message with the requiredRESTAPI fields.

ADDITIONAL INFORMATION

- Use the API fields listed in Required Fields for Authorizing a Visa Payment on Paze with Cybersource Decryption.

- Refer to the example in REST Example: Authorize a Visa Payment on Paze with Cybersource Decryption.

- Send the message to one of these endpoints:

ADDITIONAL INFORMATION

- Production:POSThttps://api.cybersource.com/pts/v2/payments

- Test:POSThttps://apitest.cybersource.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Required Fields for Authorizing a Visa Payment on Paze with

Cybersource

Decryption

Cybersource

As a best practice,

include these REST API fields

in your request for an authorization with the

decryption implementation of Paze for Visa.

Cybersource

IMPORTANT

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements

for address data and expiration dates in payment transactions, see the .

- Set this field to the Base64-encoded value returned in the Paze payload in thecompleteResponseproperty of the complete payment response object.

- Set this field to1.

- Set this field to001for Visa.

- Set this field to029to identify Paze as the digital payment solution.

REST Example: Authorize a Visa Payment on Paze with

Cybersource

Decryption

Cybersource

Request

{ "clientReferenceInformation": { "code": "1234567890" }, "processingInformation": { "paymentSolution": "001" }, "paymentInformation": { "fluidData": { "value": "eyJkYXRhW5FINWZqVjfkak1NdVNSaE96dWF2ZGVyb2c9PSJ9" }, "tokenizedCard": { "type": "001", "transactionType": "1" } }, "orderInformation": { "amountDetails": { "totalAmount": "100.00", "currency": "USD" }, "billTo": { "firstName": "Maya", "lastName": "Lee", "address1": "123 Main St", "locality": "SomeCity", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "maya.lee@email.world" } } }

Response to a Successful Request

{ "_links": { "authReversal": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/reversals" }, "self": { "method": "GET", "href": "/pts/v2/payments/6234236182176225003004" }, "capture": { "method": "POST", "href": "/pts/v2/payments/6234236182176225003004/captures" } }, "clientReferenceInformation": { "code": "1234567890" }, "id": "6234236182176225003004", "orderInformation": { "amountDetails": { "authorizedAmount": "100.00", "currency": "USD" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2031", "prefix": "411111", "expirationMonth": "12", "suffix": "1111", "type": "029" }, "card": { "type": "029" } }, "pointOfSaleInformation": { "terminalId": "111111" }, "processingInformation": { "paymentSolution": "001" }, "processorInformation": { "approvalCode": "888888", "networkTransactionId": "123456789619999", "transactionId": "123456789619999", "responseCode": "100", "avs": { "code": "X", "codeRaw": "I1" } } }

VISA Platform Connect: Specifications and Conditions for

Resellers/Partners

The following are specifications and conditions that apply to a Reseller/Partner enabling

its merchants through

Cybersource for

. Failure to meet any of the specifications and conditions below is

subject to the liability provisions and indemnification obligations under

Reseller/Partner’s contract with Visa/Cybersource.Visa Platform Connect

(“VPC”)

processing- Before boarding merchants for payment processing on a VPC acquirer’s connection, Reseller/Partner and the VPC acquirer must have a contract or other legal agreement that permits Reseller/Partner to enable its merchants to process payments with the acquirer through the dedicated VPC connection and/or traditional connection with such VPC acquirer.

- Reseller/Partner is responsible for boarding and enabling its merchants in accordance with the terms of the contract or other legal agreement with the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that all considerations and fees associated with chargebacks, interchange downgrades, settlement issues, funding delays, and other processing related activities are strictly between Reseller and the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that the relevant VPC acquirer is responsible for payment processing issues, including but not limited to, transaction declines by network/issuer, decline rates, and interchange qualification, as may be agreed to or outlined in the contract or other legal agreement between Reseller/Partner and such VPC acquirer.

DISCLAIMER: NEITHER VISA NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR ANY ERRORS OR

OMISSIONS BY THE

Visa Platform Connect

ACQUIRER IN PROCESSING TRANSACTIONS. NEITHER VISA

NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR RESELLER/PARTNER BOARDING MERCHANTS OR

ENABLING MERCHANT PROCESSING IN VIOLATION OF THE TERMS AND CONDITIONS IMPOSED BY THE

RELEVANT Visa Platform Connect

ACQUIRER.