On This Page

REST API

Payout Services

Barclays

Payout services enables businesses or government offices to

take advantage of Visa Direct and Mastercard MoneySend to deliver funds directly to a

recipient’s eligible Visa or Mastercard account.For details about authentication, see:

For field-level descriptions and request/response examples, see the

Barclays

REST API

Reference.For a quick tour of the

Barclays

REST API Reference, see this walkthrough

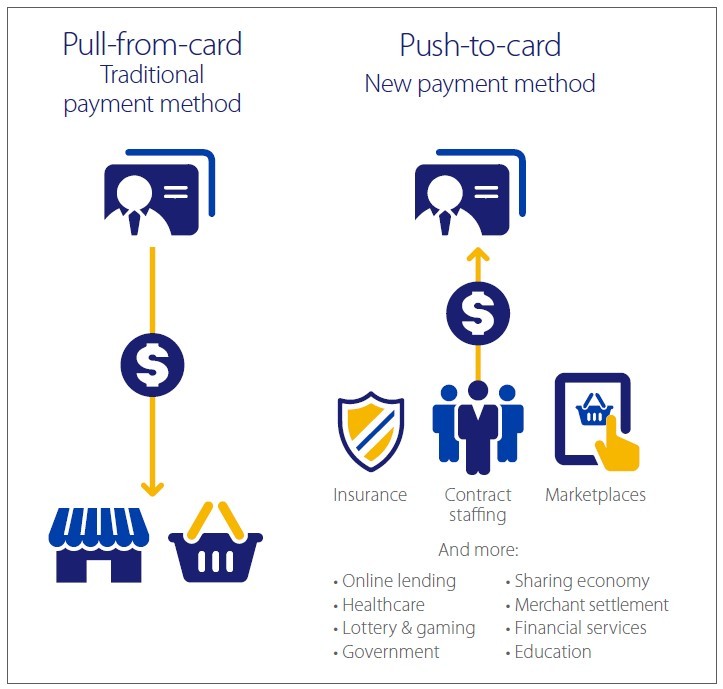

video.Unlike a purchase transaction, which debits a cardholder's account, Visa Direct and

Mastercard Send credit the cardholder's account. Funds are made available to the

recipient as quickly as within 30 minutes or a maximum of two business days, depending

on the recipient’s issuing bank.

You can implement Payouts services as part of the following types of business flows:

- Credit card bill payments are not the same as Visa Bill Pay.Credit card bill payment—originator enables customers to pay a credit card bill.

- Funds disbursements—originator sends funds to a recipient’s payment card account.

- Money transfer—originator enables customers to send funds to their own payment card account or to another person’s payment card account.

- Prepaid load—originator enables customers to load or reload funds to an eligible reloadable prepaid card.

No merchant goods are involved in Payouts transactions. To enable a person-to-person

money transfer, you first withdraw funds from the account the sender is using to fund

the transaction. One way to withdraw funds from a card account or debit account with a

linked payment card is using an Account Funding Transaction (AFT). Currently, the

Payouts service does not support AFTs.

IMPORTANT

You must screen senders and recipients using relevant watch lists

according to local laws and be compliant with all anti-money-laundering and

know-your-customer regulations.