To request an electronic check debit, set the ecDebitService_run field to true. When you request a debit, do not request any of the following services at the same time:

nAny credit card services: ccAuthService, ccAuthReversalService, ccCaptureService, ccCreditService. For information about these services, see Credit Card Services User Guide.

nElectronic check credit: ecCreditService. For information about this service, see Electronic Check Credits.

nPayPal payment or credit: payPalPaymentService, payPalCreditService. For information about these services, see the PayPal Express Checkout Services Using the Simple Order API.

Handling Customer Account Information

Service:

nDebit

Processors:

nChase Paymentech Solutions

nCybersource ACH Service

nRBS WorldPay Atlanta

nTeleCheck

Merchant-provided data handling requires you to collect the customer’s account information and provide it in your service request. The required fields are:

ncheck_accountNumber

ncheck_accountType

ncheck_bankTransitNumber

You must modify your web site to collect the account information. Retain the account information for future transactions, such as credits.

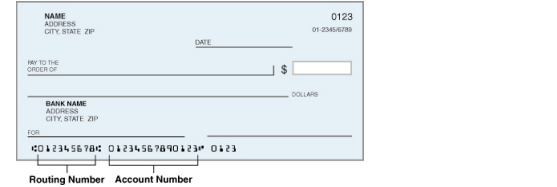

Customers might not know how to use their printed checks to find the bank routing number and the bank account number. Consider using a graphic like this on your web site:

Example 4Check Showing Routing Number and Account Number

The following events occur when you request a debit:

1Your customer places an order.

2You request an electronic check debit.

3In your request, you provide the customer’s account information.

4Cybersource sends the customer’s account information and other information about the transaction to the check processor.

5The payment processor validates the information and performs basic fraud screening.

The processor does not contact the customer’s bank to verify the existence of the customer’s account; it makes sure that only the information provided by the customer is reasonable and that the account is not a known source of fraud.

Depending on which processor you use, if there are problems with the account that prevent the transaction from being completed, the processor might charge you a returned check fee.

6The payment processor sends a reply to Cybersource indicating whether or not the debit will be processed.

7Cybersource sends a reply to you.

8You display an appropriate message to your customer.

9The processor sends the request for clearing.

Notifications of Change (NOCs)

Services:

nCredit

nDebit

Processors:

nCybersource ACH Service

nRBS WorldPay Atlanta

A Notification of Change (NOC) is a notice from a customer’s bank indicating that an electronic check transaction included incorrect customer or payment information. The customer’s bank:

1Corrects the information.

2Posts the transaction to the customer’s bank account.

3Notifies you that payment information needs to be updated.

Each NOC includes a code that specifies what needs to be changed. You are responsible for taking the appropriate action when you receive a NOC.

You must correct all applicable records before submitting additional electronic check transactions for the customer. If you are using the Token Management Service or Recurring Billing, you must update the information in your tokens, subscriptions, or customer profiles.

|

|

Cybersource maintains a database of all NOC entries. Repeated attempts to resubmit an uncorrected transaction could result in a fine and possible sanctions from the National Automated Clearing House Association (NACHA). |

To get information about the NOCs for your transactions:

Step 1Create a PGP key pair as described in Creating and Using Security Keys.

Step 2Log in to the Business Center and view the NOC Report, which is available under Transaction Reports.

You can also talk to your bank about getting a report that includes NOCs. NOC codes are described in NOC Codes.

For information about optional features such as subscriptions and deferred payments, see Optional Features.

For detailed descriptions of these fields, see Request Fields.

|

|

On TeleCheck, request field values must not contain ampersands (&). |

nbillTo_city

nbillTo_company

nbillTo_companyTaxID

nbillTo_country

nbillTo_driversLicenseNumber

nbillTo_driversLicenseState

nbillTo_email

nbillTo_firstName

nbillTo_ipAddress

nbillTo_lastName

nbillTo_phoneNumber

nbillTo_postalCode

nbillTo_state

nbillTo_street1

nbillTo_street2

ncheck_accountEncoderID

ncheck_accountNumber

ncheck_accountType

ncheck_bankTransitNumber

ncheck_checkNumber

ncheck_secCode

necDebitService_commerceIndicator

necDebitService_debitRequestID

necDebitService_paymentInfo

necDebitService_paymentMode

necDebitService_referenceNumber

necDebitService_run

necDebitService_settlementMethod

necDebitService_verificationLevel

ninvoiceHeader_merchantDescriptor

nitem_#_productCode

nitem_#_productName

nitem_#_productSKU

nitem_#_quantity

nitem_#_taxAmount

nitem_#_unitPrice

nlinkToRequest

nmerchantID

nmerchantReferenceCode

npurchaseTotals_currency

npurchaseTotals_grandTotalAmount

nrecurringSubscriptionInfo_subscriptionID